Investment Philosophy

Our focus lies on established, well positioned companies earning stable cash flows. This reduces our investment risk substaincially. Thanks to our longterm investment horizon, the evaluation of management teams and the requiered know-how of business models we do not have to follow every exaggeration of financial markets and can focus on meaningful, value enhancing investments in the field of Swiss small & mid caps.

Benchmarks do play a minor role in our investment approach because of their often suboptimal constitution.

Our principles are:

- We only invest in companies were management can be trusted and a good corporate governance is lived

- We have a clear focus on the often neglected small caps

- We invest in companies with solid balance sheets and established business models that we understand

- We look out for companies that can self finance their growth and generate free cash flows

- We invest in well established companies that have a global footprint and are leaders in their niches

- We do have a longterm investment horizon and act anticyclically

- We avoid speculative stocks and have therefore a very low portfolio turnover

- Volatility and tracking error alone are insuffient risk measures

Investment Process

Quality leads Quantity

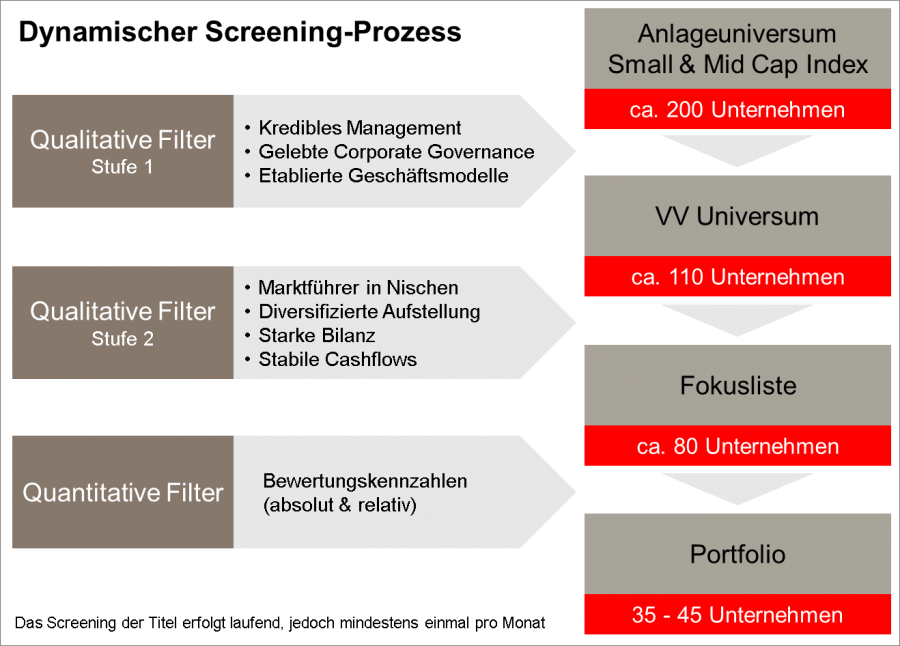

Our Investment universe consists of 200 companies that are included in the SPI Small & Mid Caps Index. The free-float adjusted market cap is CHF 170 bln.

The companies weighting within the benchmark has no influence on our following assessment, nor on our portfolio weights, which are the result of our strongest convictions.

Qualitative Filter - Stage 1

Credible Management

For us as a long-term oriented investor it is crutial that the companies are managed by a trustworthy and capable team with a understandable strategy. Companies and managements with a too short-term focus and orientation are avoided.

Lived Corporate Governance

We defend the rights of minority shareholders actively and have therefore a focus on corporate governance. Essential for an investment is a appropriate corporate governance culture.

Companies that are exposed to high political influence (Utility companies or Cantonal banks) because of their ownsership, balance sheet structure or regulatory issues are avoided. Governments or their political representatives are not the appropriate owners, too big are the conflict of interests. Politicians normally have their own agenda and act, as a result of that, not always in the interest of the companies and their shareholders.

Established Business Models

We are critical of market newcomers and eratic business models. We trust in companies that are in a position to generate recurring positive cash flows.

After this detailed analysis the remaining roughly 110 companies make up the VV Universe.

Qualitative Filter - Stage 2

Leader in their Niches

We are explicitely looking for niche players that enjoy a certain pricing power thanks to their position and setup. Normally, they comand higher and more robust margins.

Diversified Setup

We avoid companies with just a single product or client, being dependant on one single driver. We prefere companies that have a global setup and do sell into different industries. This way, the economic shortfall can be substaincially reduced.

Solid Balance Sheets

We are looking for companies with a high degree of self financing. Companies with a high leverage oder bigger goodwill positions do represent to high risks. At the wrong moment they come into a involuntary bank dependancy with all the related punitive actions.

Stabile Cash Flows

Companies that can self finance their growth thank to their stable cash flow over a cyle convince us.

After this extended content analysis the remaining roughly 80 companies form the focus list.

Quantitative Filter

The companies on the focus list are then analysed and compared using different valuations tools (i.e. FCF yield, Price/Book ratio, Price/Earnings ratio, EV/EBITDA ratio or dividend yield) or/and valuation models (DCF).

The result of this last analysis leads to the portfolio with 35 - 45 positions.

Conclusion

As a consequence of our investment process, we have a strong overweight in smaller industrial companies.

On the other hand, the following sectors are strongly underweighted or neglected, even if the are heavy-weights in the benchmark:

Biotech

- too eratic business model, self-financing capabilities often not given

Bank

- Investment banks: limited transparency, incentive asymetry (agency problem)

- Cantonal banks: political influence limits flexibility

Insurance companies

- Unattractive business model, elevated risks on the big bond portfolios, especially in todays low interest rate environment

Utilities

- Energy producers, traders and distributors: political and regulatory risks, questionable foreign expansion, high historic trading dependency.