Small Caps

In the Swiss Market Context

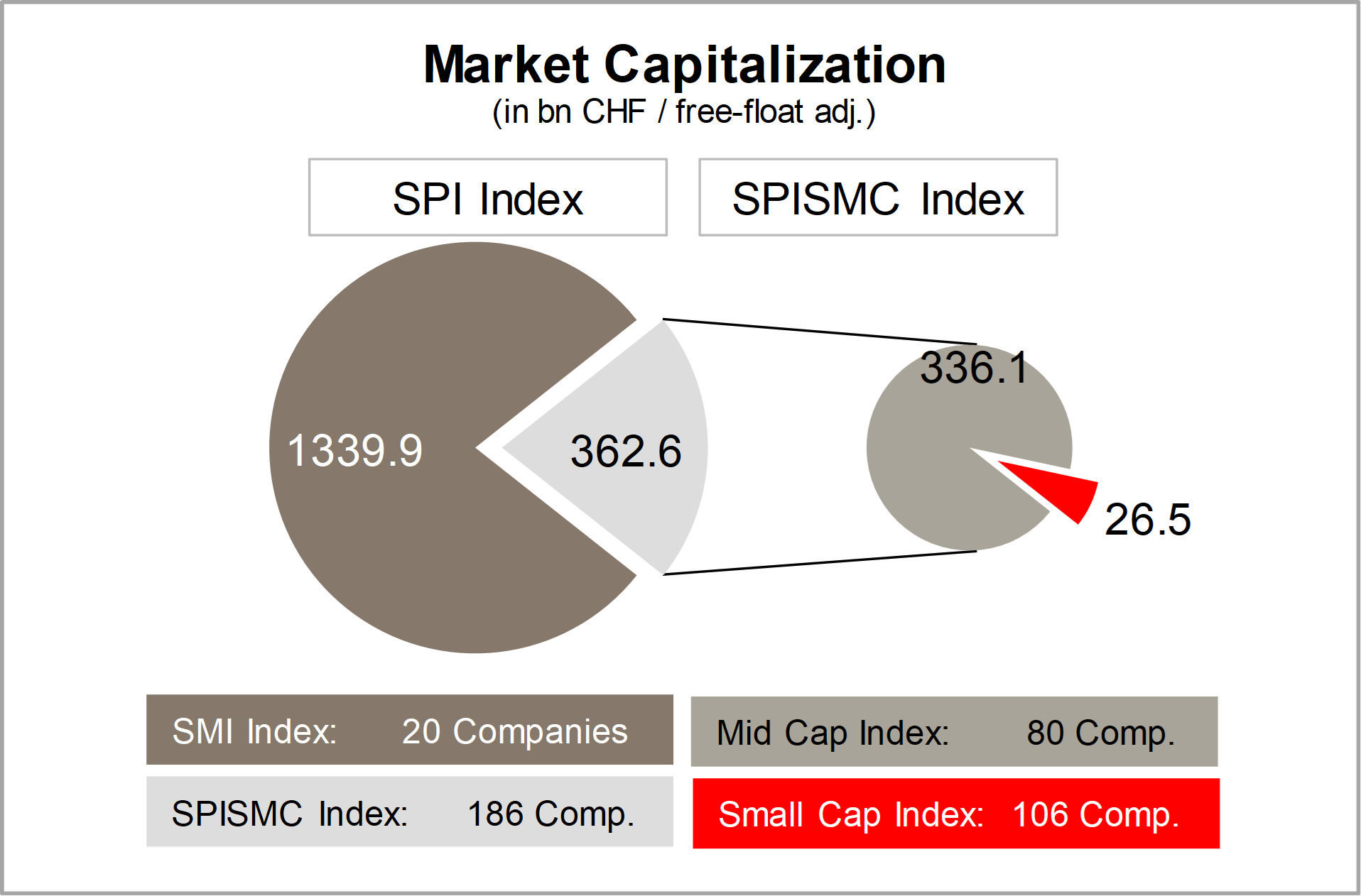

On the basis of free-float adjusted market caps the small & mid caps (SPISMC Index) has a share of about 15% of the total Swiss stock market (SPI Index). The in our portfolio over represented small caps only account for about 1.5%, even though they represent more than half of all companies

Interestingly, the free-float of the more entrepreneurial operated smaller companies is with about 50% much lower than the free-float of blue chips (>90%), which have an atomized shareholder base.

There is no analyst coverage on about half of the small caps. This offers some very interesting potential, applying own research efforts.

Small Cap Premium

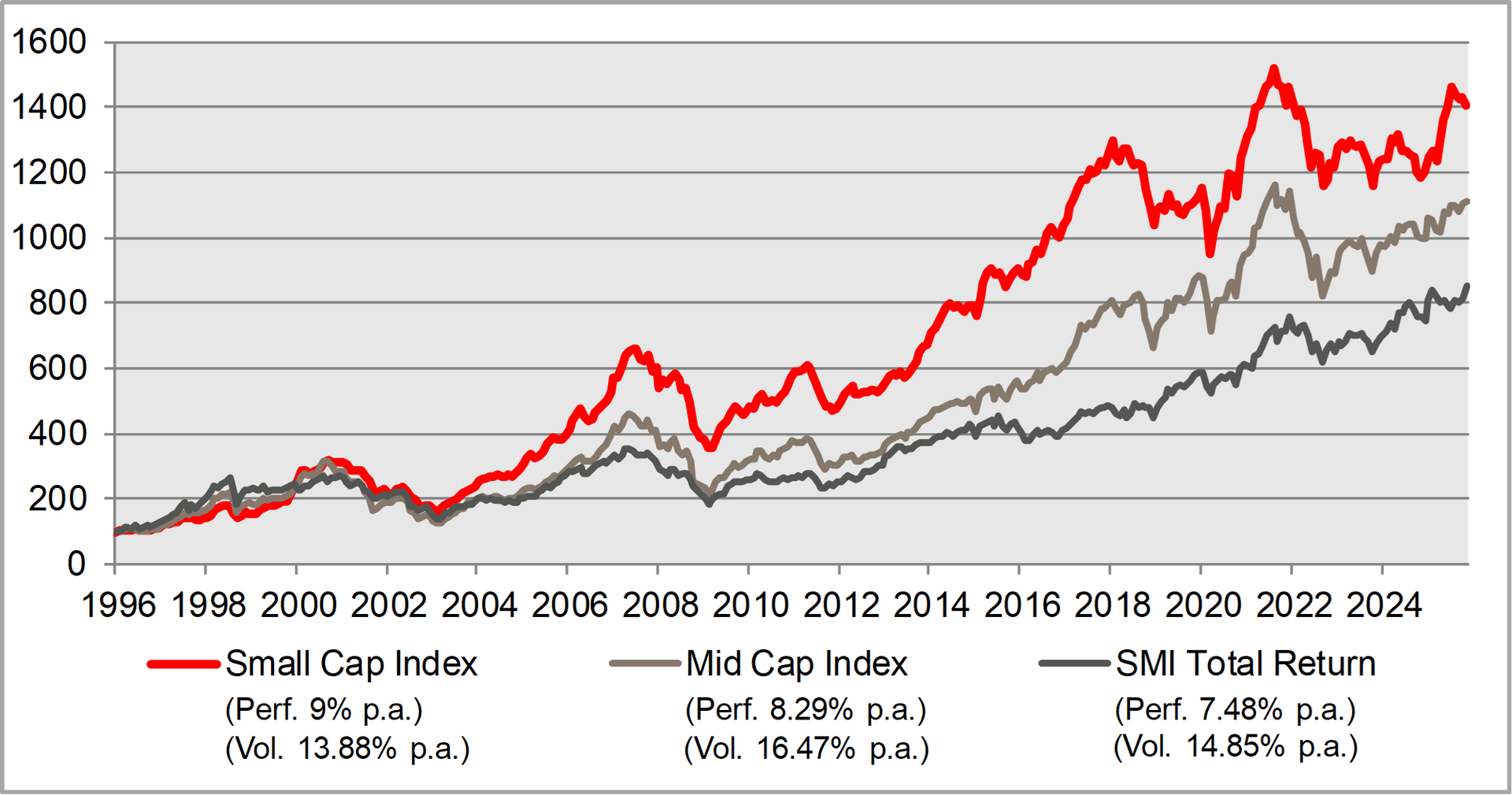

Small caps represent a very attractive investment field. In the long run, small caps do outperform blue chips by a substaincial amount. This outperformance is described as a capitalization or illiquidity premium.

In Switzerland, there has been an average yearly small cap outperformance versus blue chips of 4% since 1996. Interestingly, this has happend with a lower volatility than the mid & large caps, where more trading orienented money is causing exagerations and therefore higher volatility.